Your Premium Partner in Premium Funding

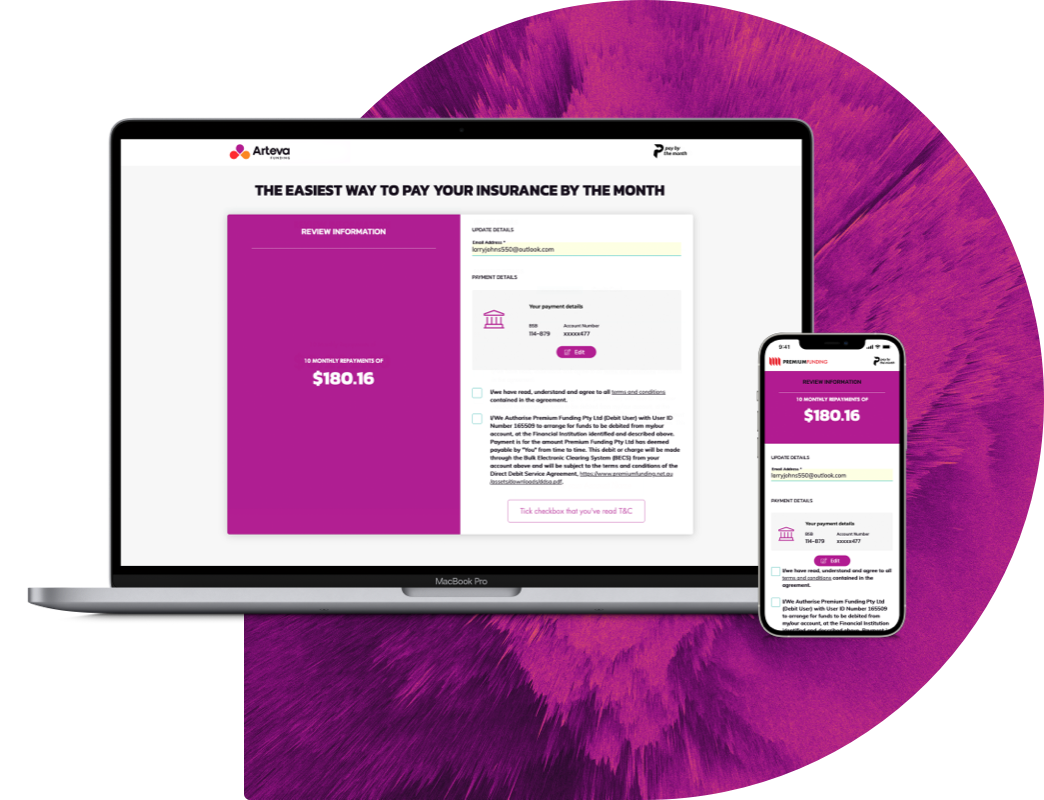

Stop letting big upfront insurance premiums drain your cash flow.Partner with us and bundle your insurance costs into simple instalments with flexible repayment options.

Your Premium Partner in

Premium Funding

Stop letting big upfront insurance premiums drain your cash flow.

Partner with us and bundle your insurance costs into simple instalments with flexible repayment options.

Insurance Premium Funding

Designed to achieve financial flexibility, create opportunityand increase affordability. Learn more